Blog

- Home

- Blog

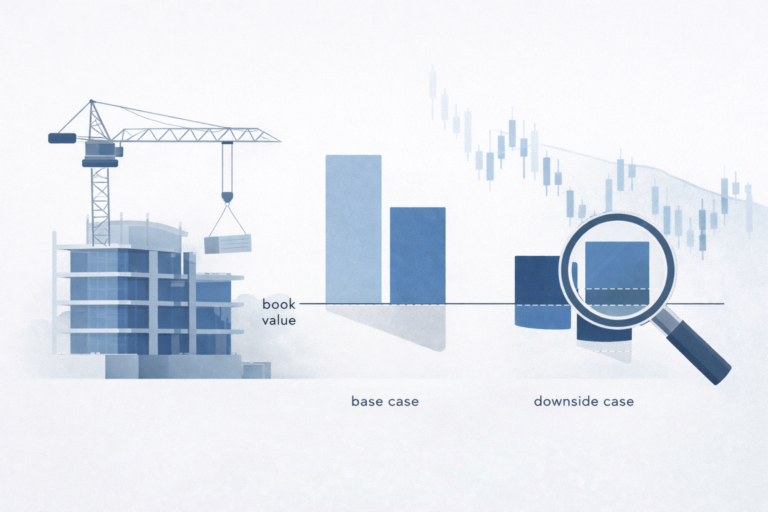

Impairment testing requires careful professional judgement. As this case study highlights, when assessing the value of potentially impaired assets, the devil is in the detail. Using a construction...

While fund managers’ ESG considerations are often considered a “labelling” exercise, a recent paper in the Journal of Banking and Finance suggests it can actually help the price discovery process...

How ESG risk is becoming an AIF valuation variable Valuation teams across Europe are realising that sustainability risk is no longer a disclosure topic — it’s a fair-value issue. Under AIFMD and the...

How can company valuations incorporate carbon emissions?A seminal paper by Bolton and Kacperczyk (2021), Do Investors Care About Carbon Risk?, offers valuable guidance. The authors examine stock...

Academic research into sustainability drivers of corporate valuation is increasingly moving into the field of machine learning.A recent paper by Turkish researcher Murat Doğan and colleagues is a good...

Over the past years, the finance community has become a growing consumer of companies’ carbon information – both at the corporate level and, increasingly, at the level of products and services. Why is...

We are often asked around the importance of ESG data in company valuations. When does sustainability come out most prominently in valuation assignments? It is typically one of two types of companies:...

EU Taxonomy impact on shareholder value The EU Taxonomy marked one of the first legislative attempts to set a commons standard for the “greenness” of a company. Seeking to elevate this from more...