Academic research into sustainability drivers of corporate valuation is increasingly moving into the field of machine learning.

A recent paper by Turkish researcher Murat Doğan and colleagues is a good example. It concludes that:

- Machine learning models show environmental performance and ESG controversies to be the most influential sustainability factors for firm value, and

- ESG factors provide the greatest predictive value for valuing American and European companies.

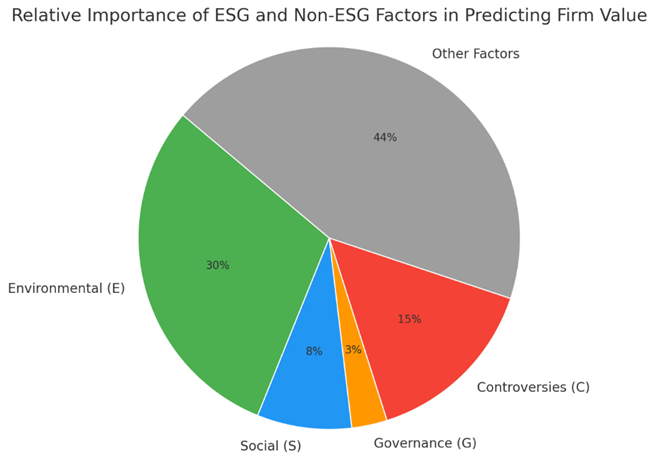

The authors’ preferred approach, the Random Forest Model, produces predictions on the relative importance of different factors, illustrated in the accompanying pie chart. Their study covers approximately 5,400 listed firms worldwide over the period 2018–2022, across ten corporate sectors including energy, industrials, and consumer goods.

Among the factors assessed — a combination of ESG scores and traditional financial ratios sourced from Refinitiv — environmental performance clearly emerged as the most important, with a relative weight of 0.30. In practical terms, this means a company’s environmental management and risk profile typically have a much stronger influence on its market value than its social (0.08), governance (0.03), or controversy (0.15) scores.

The study does have limitations, as the authors themselves acknowledge. It draws on a relatively narrow set of financial and business variables, faces challenges from incomplete ESG reporting, and does not account for differences between ESG rating providers.

Nevertheless, the findings reinforce a key message: any serious valuation of modern corporations increasingly needs to incorporate ESG factors — particularly environmental risks and controversies — alongside traditional financial analysis.

Source

Murat Doğan, Özlem Sayılır, Muhammed Aslam Chelery Komath, Emre Çimen. Prediction of market value of firms with corporate sustainability performance data using machine learning models. Finance Research Letters. Volume 77, 2025